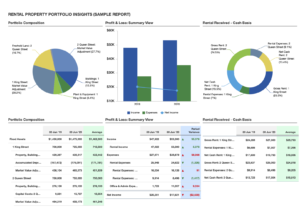

Powerful portfolio insights

Property and investment portfolio services has become a niche area within our firm.

This is because we give investors the confidence and peace of mind that we are properly managing the bookkeeping, accounting and tax compliance function for their investment portfolios.

From maintaining capital gains records to complex CGT calculations, preparing live profitability reports, through to BAS and tax lodgements, we ensure that you never miss a lodgement deadline.

Using our latest technology software, we can provide you with real-time reporting across your multiple entities including within your SMSF.

Tax Compliance & Advisory

The ATO know that 89% of all property returns completed contain errors. That’s an alarming statistic and proves that rental property returns are far from straight forward to prepare!

That’s why we take tax compliance seriously to avoid costly fines in case of ATO audit.

We’d prefer you to fall into the “correct” category which means we’ll take care to ensure that your rental property returns are completed correctly!

We can also advise you on legitimate tax planning strategies across your multiple properties in your portfolio and can consider the optimum tax structure in which to operate.

Negative Gearing & Loans

We provide peace of mind by quantifying the tax-saving benefits of negatively gearing within your investment portfolio.

Whether you own properties, shares, managed investments or other asset classes, we can advise you of the negative gearing strategies and tax savings.

We can also introduce you to a team of professionals to assist in other matters relating to your property. From property agents to conveyancing experts and mortgage lenders – and we don’t earn commissions giving you peace of mind that we are acting in your interest at all times.

For more information on how we can assist you and our various packaged services, please contact Steven Want.

7 steps to increasing profit

Enter your details below and sign up to our course, which also includes FREE template to help you plan your strategy.

Request a Consultation

Book your free no-obligation consultation and find out how we can help your business!